State Of Ohio Exempt Employee Benefits

Rule 335712-3-03 Exempt and non-exempt personnel definition. Deductions from pay are permissible when an exempt employee.

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration Pathways

Moss said an employer must give you a paycheck at least twice a month in Ohio.

State of ohio exempt employee benefits. For new employees. OH Statute 411103D3d Administrative exemption Ohio exempts administrative employees from its. The state of Ohio has multiple exemption certificates.

There is a common misconception that salaried means exempt under the Fair Labor Standards Act FLSA or Ohio wage laws. FfProbationary periods for exempt employees are one year from the date of hire and 6 months after every promotion. Office of Benefits Administration Services This office provides State employees with high quality cost-effective benefits.

To qualify for the executive employee exemption an employee must meet the requirements established under the federal Fair Labor Standards Act and its related regulation. The EyeMed Insight network encompasses a large number of providers. An employee withholding exemption certificate is the official form that an employer is supposed to use for federal or state income tax withholding purposes.

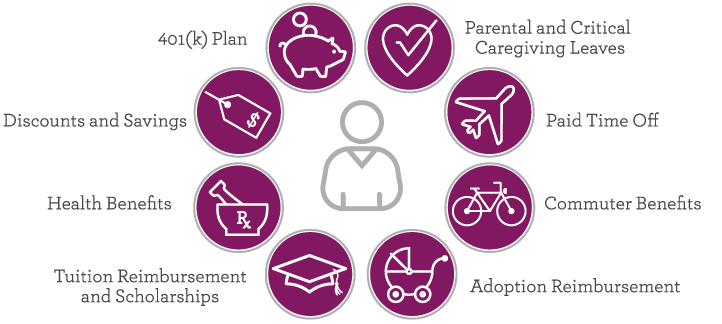

BAS solicits procures and manages State of Ohio employee benefit services from commercial vendors of insurance products including medical dental prescription drug vision behavioral health EAP basic and supplemental life insurance and health management services. The State of Ohio requires employers to pay at least minimum wage for all hours worked and overtime is required for all hours worked over 40 hours in week. Sick leave is considered a fringe benefit and the Bureau of Wage Hour Administration cannot enforce fringe benefits.

State of Ohio provides certain exempt employees who have more than one year of continuous state service with basic term life insurance benefits. Advertentie Verwerf een helikoptervisie op compensation benefits management. This results in underpayment for employees who are entitled to.

However state requirements vary. Vision coverage is offered to exempt employees through EyeMed Vision Care. This section provides an overview of these benefits.

The State of Ohio provides a variety of quality competitive benefits to eligible full-time and part-time employees that range from affordable health care to discounts to popular Ohio entertainment venues. Under federal statutes certain employees such as managers professionals and administrators may be classified as exempt employees. This free benefit is provided at one times your annual salary to the next highest thousand.

There are somewhat different requirements for domestic employment agricultural employment non-profit organizations exempt from federal income tax under Section 501c3 public entities employers subject to the Federal Unemployment Tax Act and employers who have acquired a business from an employer who was subject to Ohio law at the time the change occurred. B Exempt and non-exempt status determines overtime eligibility. If you are an exempt employee with one year of continuous state service the state pays the full cost for you and your eligible dependents to participate in a dental plan.

The Fair Labor Standards Act identifies two classes of employees. Non-exempt employees must receive time and a half pay under federal and state. The State of Ohio has two categories of employees.

The state of Ohio recognizes the same exemptions to overtime and minimum wage laws as the federal government. 1 While many exempt employees are salaried 2 not all salaried employees are exempt. On time pay.

Salaried Employees Can Be Either Exempt or Not Exempt. Employees and their family members who choose to receive services outside of the vision plan network may be subject to a reduction in benefits. A The Fair Labor Standards Act requires overtime payment for hours worked in excess of forty hours per week.

Employee services policies and benefits. State employees and their spouses can receive a COVID-19 vaccination at no cost and those who received a COVID-19 vaccination prior to August 2 2021 are eligible for the incentive payment. Bargaining Unit and Non-Bargaining Unit.

Executive exemption Ohio exempts executive employees from its minimum wage and overtime requirements. You can choose to participate in either the Delta Dental PPO or the Delta Dental Premier plan offered through Delta Dental of. Federal withholding requires employers and employees in the United States to use a standard form.

All State of Ohio employees and their spouses are encouraged to protect themselves their families and their communities by getting a COVID-19 vaccination. Employees that are considered highly compensated who make more than 10743200 per year are also exempt from these requirements if they perform at least one of the duties of a bona fide executive administrative or professional employee. Advertentie Verwerf een helikoptervisie op compensation benefits management.

How Unemployment Benefits Are Calculated By State Bench Accounting

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration Vision

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration

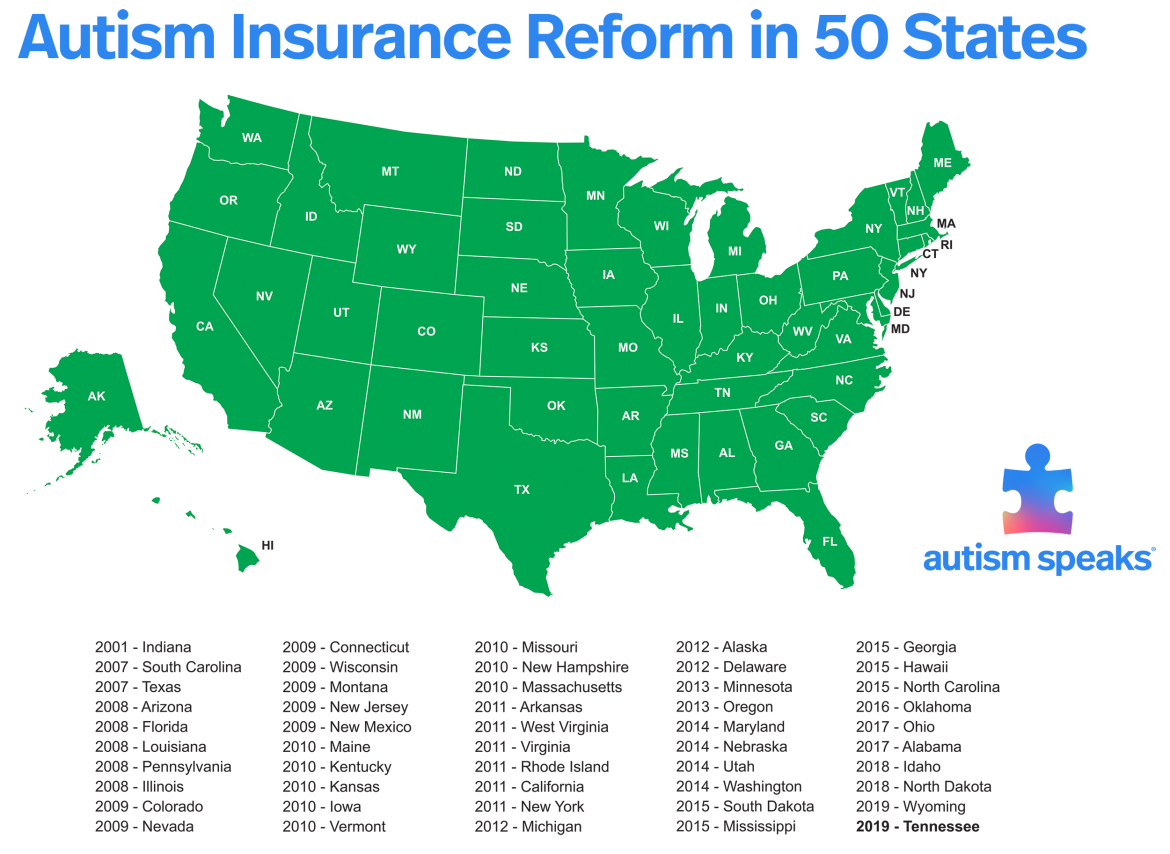

State Regulated Health Benefit Plans Autism Speaks

7 Benefits Of Having A Medical Marijuana Card In A Rec State Veriheal

7 Steps To Start A Business Business Format Starting A Business Limited Liability Partnership

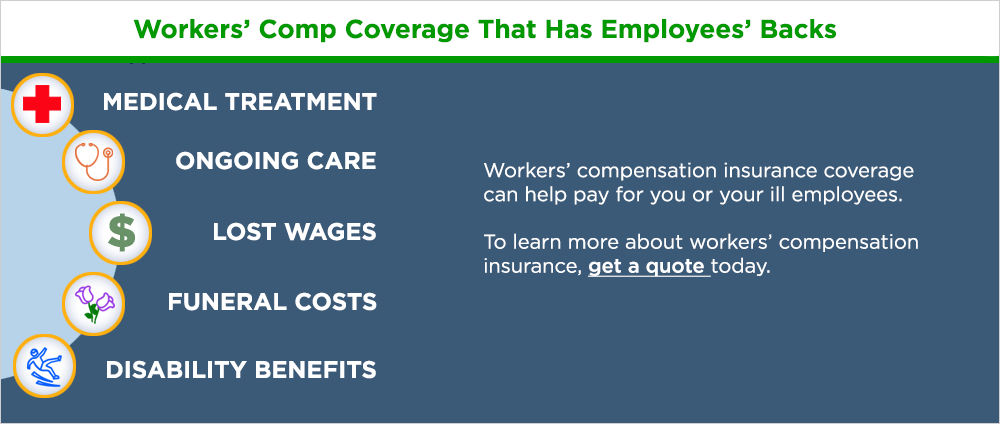

Independent Contractors Workers Comp Benefits In Ohio D B Blog

Are You Properly Classifying Sales Employees Connectedpayroll Payroll Connectpay In 2020 Business Continuity Planning Payroll Business Continuity

Benefits Compensation Archived Questions Of The Week

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Do Church Employees Qualify For Unemployment Benefits Church Law Center

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration Pathways

Common Fringe Benefits Rules For 2 S Corp Shareholders And Changes Under The Cares Act

Teacher Assistant Resume Sample Teacher Assistant Resume Sample With No Experience Teacher Assistant Education Resume Preschool Teacher Resume Teacher Resume

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration

What Does Worker S Compensation Cover The Hartford

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration

Department Of Administrative Services Divisions Human Resources Hrd Benefits Administration

Post a Comment for "State Of Ohio Exempt Employee Benefits"