State Of Ohio Employees Retirement

Our goal is to provide retirement security to the employees who manage the daily operations of K-12 schools community schools and community colleges. If you work under Ohio Public Employees Retirement System OPERS or State Teachers Retirement System STRS in addition to SERS you might be able to retire from the highest paying position and continue in the lower-paying job.

Uniplaninvestmentcounsel Inc Has 28 53 Million Holdings In Apartment Investment And Manageme Apartment Investments Investing Multifamily Property Management

For the most current state employee salary information see Ohios Interactive Budget.

State of ohio employees retirement. State Teachers Retirement System of Ohio 8882277877 275 E. Ohio Police Fire Pension OPF already started their cuts the Dayton Daily News reported. We hope that youll find the information research and resources weve assembled for your helpful and that youll call us with your questions.

Highway Patrol Retirement System HPRS Police and Fire Pension Fund OPF Public Employees Retirement System OPERS School Employees Retirement System SERS State Teachers Retirement System STRS. OPERS provides retirement disability and survivor benefits for more than 1 million public employees. Ohio public pensions are the state mechanism by which state and many local government employees in Ohio receive retirement benefits.

With 912 billion in assets OPERS is the largest public pension fund in Ohio and the 11th-largest public pension fund in the United States. Generally public employee pension benefits are prescribed by state law and changes require approval by the Ohio General Assembly. Thank you for visiting the School Employees Retirement System of Ohio SERS.

Staff post-doctoral researchers and interns are eligible to participate in an OPERS plan. Thus if an Ohio resident earns or receives retirement income it is subject to tax in Ohio even if the taxpayer previously lived or worked in another state. Broad St Columbus OH 43215.

If you continue in the lower-paying position after you retire you will be a reemployed retiree. A listing of Ohios public retirement systems. Of these seven were state-level programs while the remaining system was administered at the local level.

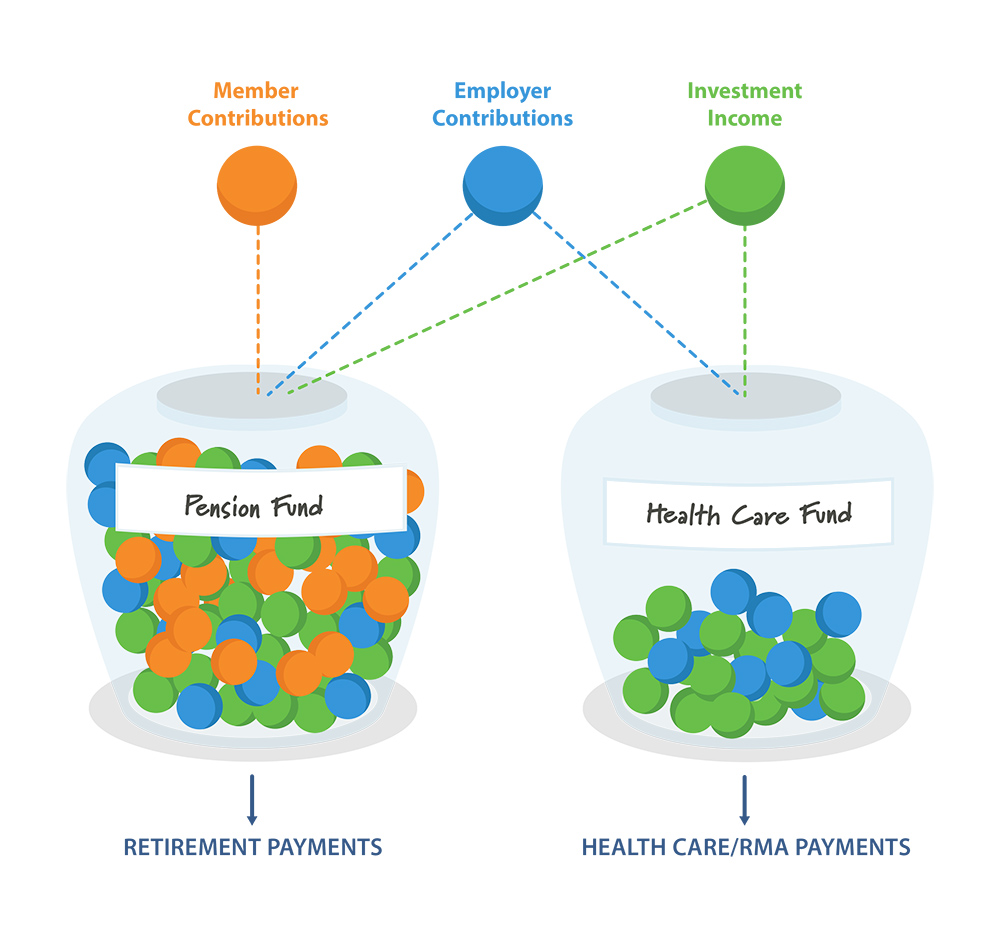

According to the United States Census Bureau there were eight public pension systems in Ohio as of 2016. The percentage of the employer contribution to be deposited into the employees OPERS account depends on which plan is selected. The retirement systems are.

The State of Ohio strives to be as open and transparent as possible concerning state employee data. The Ohio Public Employees Retirement System OPERS plans to cut benefits to future state employees beginning with those hired after January 1 2022. The Interactive Budget includes search tools and payroll information by agency.

The five state retirement plans in Ohio can be challenging to navigate and weve had the privilege of helping hundreds of state employees and their families prepare for a successful retirement. School Employees Retirement System of Ohio. The state also maintains four retiree health plans.

This includes any amount included in the taxpayers federal adjusted gross income. A state can only tax the retirement income of a resident taxpayer. If you have service credit in the School Employees Retirement System of Ohio the State Teachers Retirement System of Ohio Defined Benefit Plan or the Ohio Police Fire Pension Fund you may retire independently from each system or have your contributions and total service credit in the OPERS Traditional Pension Plan School Employees Retirement System and State Teachers Retirement.

Ohio has four large state-administered pension systems two smaller state-administered systems and some locally-administered systems. This analysis focuses primarily on the four large state-administered systems the Ohio Public Employees Retirement System PERS the State. This report contains a listing of each state employee hisher agency position title and gross pay from the most recent pay period.

Your employer also contributes a percentage to your retirement. Contributions to your retirement are automatically deducted from your earned salary. 2021 Ohio Public Employees Retirement System 1-800-222-PERS 7377 Privacy Statement Disclaimer Ohio PERS Homepage.

Ohio Public Employees Retirement System OPERS is the retirement system for state and local government employees. The Ohio Public Employees Retirement System OPERS one of two state-mandated retirement programs was established to provide a secure retirement for Ohios public employees and their families.

Show Me The Money Tracing Pre Marital Retirement Accounts In Kentucky And Ohio Ez Law Pllc Law Blog Family Law Attorney Show Me The Money

East Akron Goodyear Hall Employee Cafeteria My Uncle Jim Keys Worked At Goodyear Hall S Food Services Ordering All The Ohio History Akron Ohio Cleveland Ohio

Public Retirement Systems Ohio Gov Official Website Of The State Of Ohio

Oklahoma Students Still Fall Behind The National Average In Math And Reading According To The Annie E Casey Counting For Kids Education Issues Public School

State Defined Contribution And Hybrid Retirement Plans

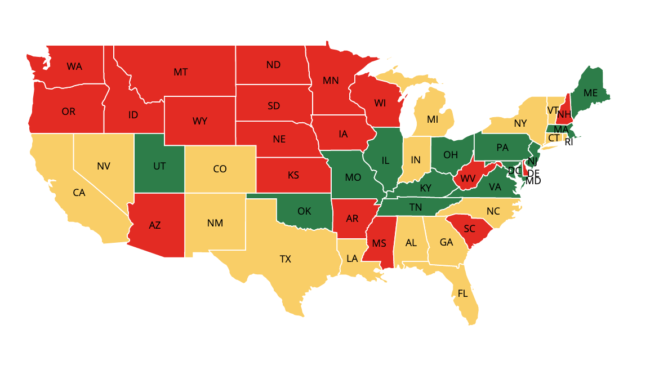

2021 S Best And Worst States For Retirement News Mcknight S Senior Living

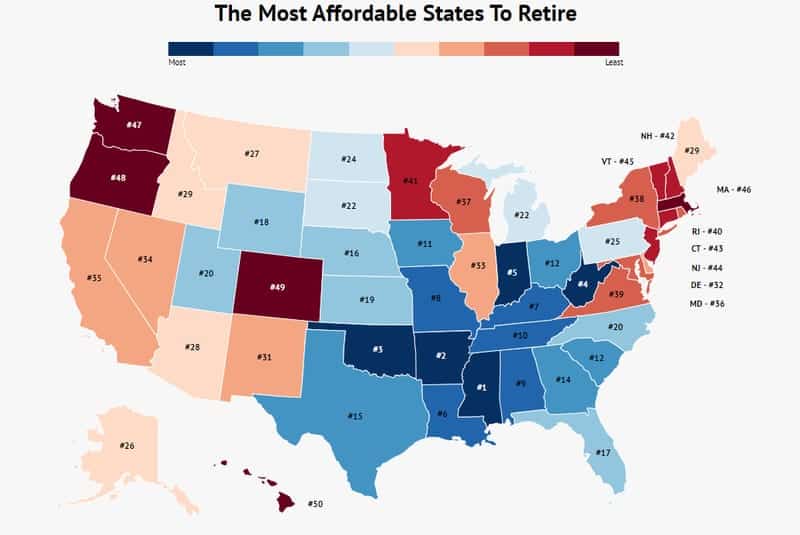

The Absolute Cheapest States To Retire In 2020 Zippia

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Participant Education Center In 2021 Education Center Health Savings Account Education

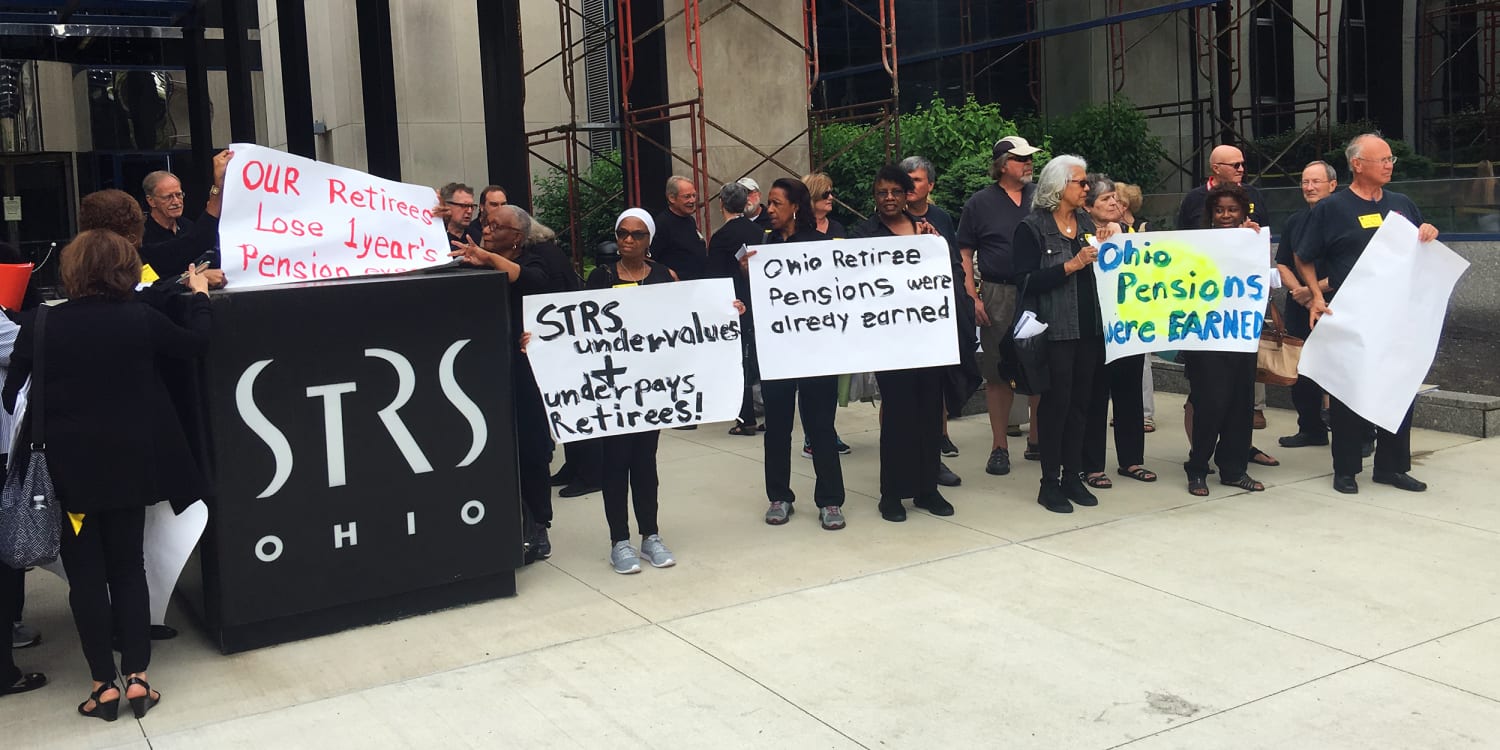

Private Equity And Hedge Fund Firms Invested Pension Cash For Retired Ohio Teachers Here S What Happened

State Mandated Retirement Plans Retirement Legislation Adp

Pin By 7 Arrow On Expo Job Fair Ohio State Ohio

What Is The Real Value Of 100 In Your State Tax Foundation State Tax Economic Analysis Map

Post a Comment for "State Of Ohio Employees Retirement"